Xero: Your Go-To Cloud Accounting Solution for Small Businesses

In today’s fast-moving business world, efficient financial management is key to staying ahead. Xero stands out as a top-tier cloud accounting platform built to simplify bookkeeping, invoicing, and overall financial tasks for small businesses. With an intuitive interface, robust features, and seamless integrations, Xero is changing the way small businesses manage their finances. In this blog, we’ll dive into what makes Xero a top choice, explore its standout features, and see how it can benefit your business.

Why Choose Xero?

Xero is tailor-made for small businesses, offering a flexible, cloud-based accounting solution that meets their specific needs. Since its launch in 2006, it has earned the trust of millions around the globe. What makes Xero special is its simplicity, real-time collaboration capabilities, and all-in-one functionality. Unlike traditional software, Xero lets you access your financial data anytime, anywhere—perfect for today’s dynamic work environments.

Ready to explore? Head over to the official Xero website to get started.

Key Features of Xero

1. Bank Reconciliation

Easily sync your bank accounts to automatically import and categorize transactions—making reconciliation fast and hassle-free.

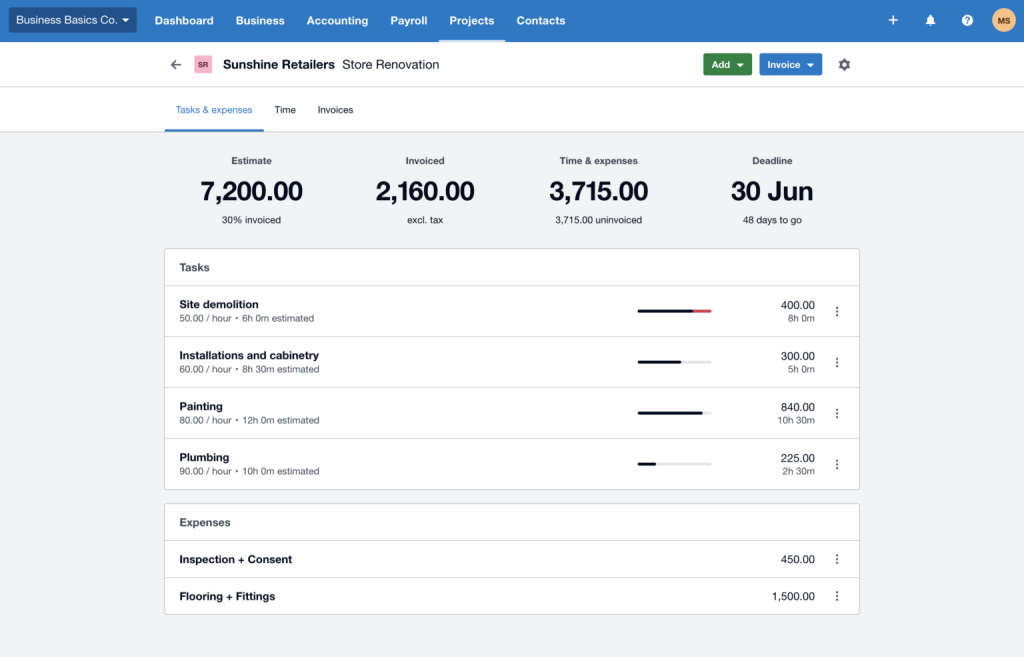

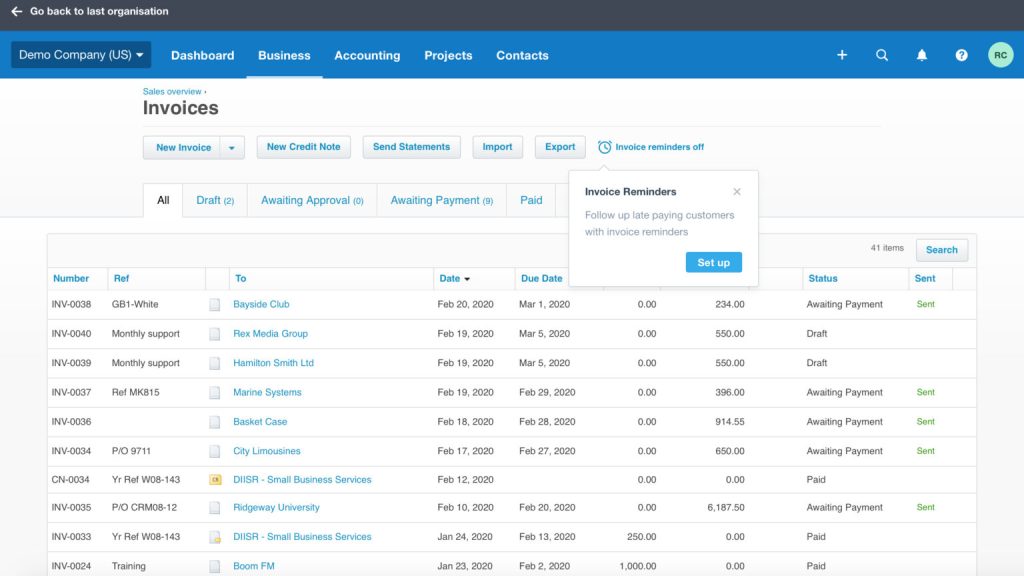

2. Invoicing & Billing

Create and send professional invoices, schedule recurring billing, and monitor payments in real time for better cash flow management.

3. Expense Tracking

Snap photos of receipts and track expenses on the go with Xero’s convenient mobile app.

4. Payroll Management

Streamline payroll processing—calculate taxes, manage employee pay, and handle payments all within the platform.

5. Financial Reporting

Access comprehensive reports like profit & loss statements, balance sheets, and cash flow summaries to stay on top of your financial health.

6. Multi-Currency Support

Effortlessly manage transactions in various currencies—perfect for businesses with global operations or international clients.

7. Third-Party Integrations

Connect Xero with popular tools such as PayPal, Stripe, and Shopify to automate and simplify your workflow.

Why Businesses Love Xero

User-Friendly Interface

Xero’s clean, intuitive design makes it simple for anyone—accountant or not—to manage their finances with ease.

Real-Time Collaboration

Easily share access with your accountant or bookkeeper, allowing for smooth, real-time collaboration and support.

Cloud-Based Accessibility

View and manage your financial data anytime, anywhere, on any device with an internet connection.

Automation Features

Automate routine tasks like importing bank feeds, sending invoice reminders, and reconciling transactions—freeing up valuable time.

Scalability

Whether you’re just starting out or growing fast, Xero scales with your business with flexible plans to suit your needs.

Potential Challenges with Xero

Learning Curve

New users might need some time to get comfortable with all the available features and settings.

Limited Advanced Features

While Xero is perfect for small businesses, larger enterprises may find it lacks certain advanced accounting tools.

Pricing

For businesses with complex requirements, Xero’s pricing may be higher compared to some budget-friendly alternatives.

Customer Support

Some users on lower-tier plans have noted that support options can be limited or slower than expected.

Who Is Xero Best Suited For?

Small Businesses: Ideal for handling day-to-day financial management, invoicing, and payroll.

Freelancers: Great for tracking income, expenses, and managing taxes independently.

Accountants & Bookkeepers: Enables seamless collaboration and easy access to client data.

E-Commerce Businesses: Works well with platforms like Shopify and WooCommerce for smooth financial integration.

Xero vs. Competitors: Feature Comparison

| Feature | Xero | QuickBooks | FreshBooks |

|---|---|---|---|

| Bank Reconciliation | ✅ Yes | ✅ Yes | ✅ Yes |

| Payroll Management | ✅ Yes | ✅ Yes | ❌ No |

| Multi-Currency Support | ✅ Yes | ✅ Yes | ⚠️ Limited |

| Pricing | 💰 Mid-Range | 💰 Mid-Range | 💸 Affordable |

| Integrations | 🔗 Extensive | 🔗 Extensive | 🔗 Moderate |

Tips to Maximize Xero’s Potential

1. Use Bank Feeds

Set up bank feeds to automatically import and categorize transactions—reducing manual entry and saving time.

2. Leverage Automation

Take advantage of Xero’s automation tools, such as invoice reminders and recurring bills, to streamline routine tasks.

3. Explore Integrations

Connect Xero with popular tools like PayPal, Stripe, and Shopify to create a seamless and efficient workflow.

4. Generate Reports Regularly

Make informed business decisions by using Xero’s robust reporting features to track your financial performance.

5. Train Your Team

Ensure your team understands how to use Xero effectively by investing in proper training or utilizing Xero’s help resources.

Is Xero Worth It?

Absolutely. Xero is a comprehensive, cloud-based accounting solution that simplifies financial management for small businesses. Its intuitive interface, real-time collaboration, and time-saving automation features make it a standout option for business owners, freelancers, and accountants alike.

While it does come with a learning curve and may be priced slightly higher than some alternatives, the value it delivers in terms of functionality, scalability, and user experience makes it a smart investment for growing businesses. If you’re looking to take control of your finances with a reliable and flexible tool, Xero is well worth considering.